Google Analytics: Excluding Paypal and Credit Card Payment Providers

Introduction

When we carry out Google Analytics audits on ecommerce sites, one of the most common issues that we find is the Referral Exclusion List for the Google Analytics property hasn’t been setup to exclude the PayPal or credit card payment providers

This means that instead of the transactions being attributed to the correct marketing channel, such as your Google Adwords campaigns, the sale is attributed to the credit card payment gateway instead.

To all intents and purposes that marketing information is lost forever.

Why Does This Happen

When you purchase from a site, the actual credit card transaction is mostly handled via a third party system which does all the anti fraud checks and ensures that the payment is legitimate.

Most, but not all sites take you a third party web site which certainly won’t have your Google Analytics tracking code on them and won’t let you install it on there.

When you return back to the site and arrive on the the ‘thank you’ page you’re starting a new session.

Google Analytics records the

- The thank you page as the landing page

- The payment provider as the source

The Referral Exclusion list allows you to tell Google Analytics to ignore them.

How the Referral Exclusion List Works

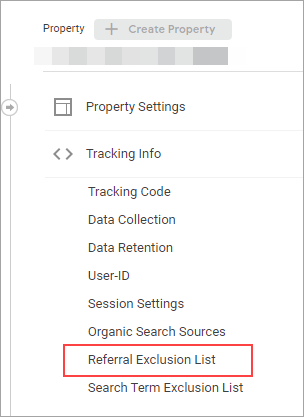

This is found in the Property Settings > Tracking Code section of the Google Analytics admin section

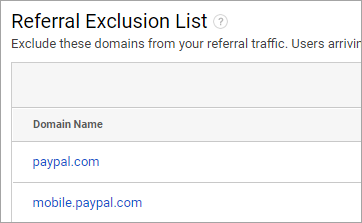

Adding a domain or subdomain to this section, it tells Google Analytics to not start a new session when people arrive that domain or subdomain.

In the example below, anyone who comes from paypal.com will not start a new session if one already exists

How To See If Your Site Is Impacted

We’ve built a Google Analytics segment that shows visits from known payment providers.

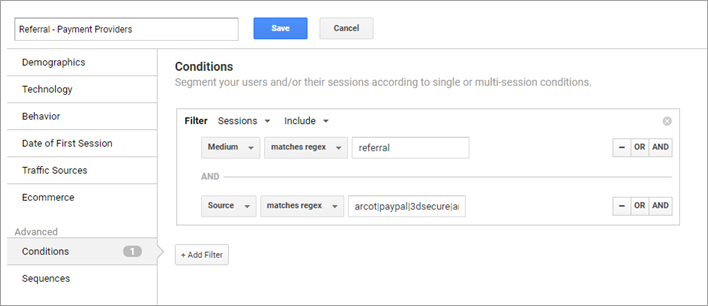

It uses the following regular expression to look in the source field for referrer than contains the following

- 3dsecure

- adyen

- americanexpress

- arcot

- barclaycard

- barclays

- cardinalcommerce

- cardsecurity

- clearpay

- klarna

- lloydstsb

- mycardsecure

- paypal

- securecode

- securesuite

- verifiedbyvisa

- visa

This is based on working with UK based retailers, so we can’t guarantee it won’t capture everyone, but it should pick up quite a lot of them

Select the link below

https://analytics.google.com/analytics/web/template?uid=K5asTGL4SQ-NWUX63QyPIQ

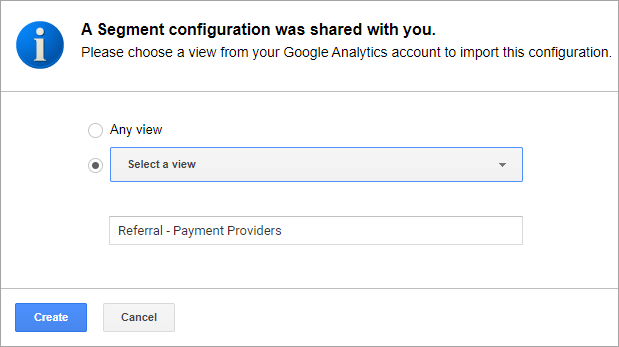

Google Analytics will ask you which account you wish to apply it to

Press Create and the following screen will appear

Press Save and the Segment will be Saved

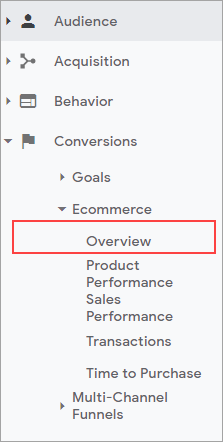

Now navigate to Conversions > Ecommerce > Overview in the main interface

Select the Add Segment

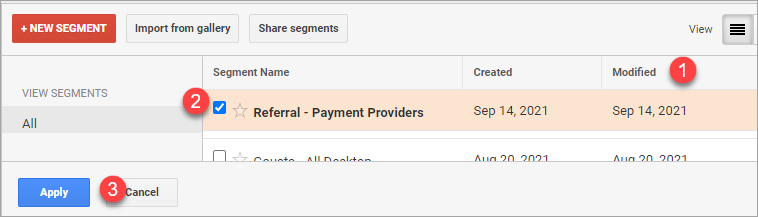

The quickest way to find the new segment is to

- Select Modified to get find the recently created

- Tick the box

- Press the Apply button

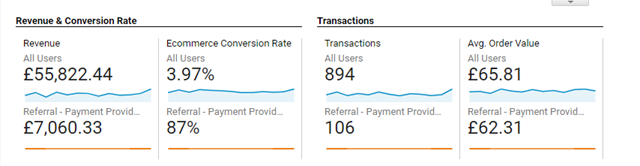

You’ll see all transactions and the ‘Referral – Payment Providers’ side by side.

In this example, we can see that the £7,060 is being attributed to the payment providers which is around 12% of all transactions

You can also see that conversion rate is far higher than normal which is because people are converting as soon as they arrive on the site.

How To Spot The Payment Providers

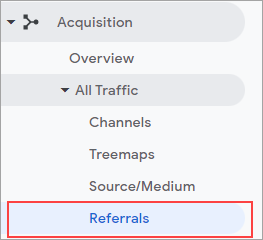

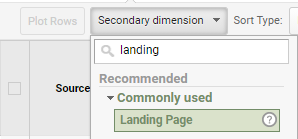

Navigate to Acquisition > All Traffic > Referrals

Select the secondary dimension button and select Landing Page

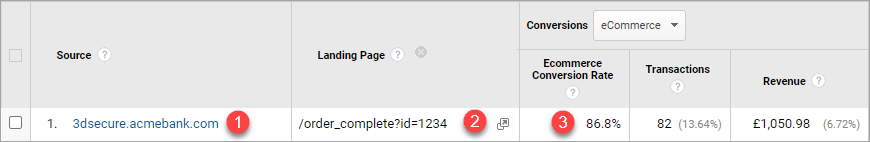

Three things to look for are

- Sources that appear to come from a bank or other financial institution

- People that arrive directly on an order complete page

- A high ecommerce conversion rate (people transact as soon as they arrive)

Next Steps

Once you’ve identified the payment providers, add them to the Referral Exclusion list

Note that this will only apply to data going forward and that legacy data can’t be recovered

Need Help

If you need help with this or any other aspect of Google Analytics setup, please call us on 0207 993 5482 or call contact us